The Crypto Wallet Revolution: Why Gasless DeFi Transactions Are a Game-Changer for Users in Emerging Markets

Gasless transactions are transforming how everyday people interact with DeFi wallet apps, especially in emerging markets where traditional gas fees create real financial barriers. By removing the cost of entry, gasless DeFi wallets empower users to explore, transact, and grow in the crypto space without hesitation. From meta-transactions to relayer systems already live in apps like Rainbow, Zerion, and BlockWallet, the technology is no longer a future promise—it’s a present reality. For individuals who’ve felt left out of Web3 due to high gas fees, this is the moment to dive back in. Because with gasless crypto transactions, the path to full crypto adoption just got a whole lot clearer.

A close friend once relayed his story about gas fees and how he abandoned his wallet and, in his words, ran for his dear life when he realised the gas fee he was mandated to pay was higher than the actual value of the tokens he was trying to move. According to Musa, he had just discovered a new decentralised finance (DeFi) app that promised to help him save and earn yields in USDT.

A more experienced friend guided him through it, starting from encouraging him to download a DeFi wallet app and to also create his account. Musa had just received a small amount of crypto from a community airdrop. Excited to try it out, he attempted to transfer a few tokens to stake them, but immediately he was met with a fierce dead end.

Alas! The gas fee was actually twice the value of the tokens he was trying to transfer.

Again, in his words, Musa ran for his dear life because, according to him, he was completely bewildered as well as frustrated. He immediately abandoned the wallet ( what any other person would have done) and returned to the world he was more familiar with, the centralised apps, where he had always enjoyed instant and free transactions and where he never needed a deep understanding of “gas” or “Gwei.”

As I gained better experience and moved deeper into the world of crypto currency and the web3, I have come to realize that Musa's experience is far from being considered as unique and the reason for this is because all across emerging markets—in India, Brazil, Ghana, and the Philippines—millions of first-time Web3 users are trying to explore decentralized finance through DeFi wallet apps, only to find themselves in the same position my friend found himself - blocked by gas fees they don’t understand, can't afford, or simply shouldn’t have to worry about.

In my personal opinion, this is the friction point—the very invisible barrier that continues to discourage the adoption of crypto globally, especially among the very users DeFi was meant to empower.

But I believe the industry is fighting back. A new breed of gasless crypto transactions is gaining traction, built into innovative DeFi mobile wallets and dApps that absorb gas costs or reimagine the way users interact with the blockchain. These gasless solutions are now driving the next wave of crypto adoption, offering a smoother, more inclusive Web3 experience for everyone—regardless of technical know-how or economic status.

In this article, I will explore the problem of gas fees, break down the technology behind gasless transactions, and spotlight the wallet apps making crypto more usable and accessible than ever before.

So, whether you're a curious beginner or a seasoned DeFi user, this deep dive will show you why gasless transactions aren’t just a feature but a new movement. One that could redefine the future of crypto, starting now.

If this sounds like an interesting exposé to you, then ride along with me...

First off, Let's Consider The Gas Fee Barrier in DeFi.

In decentralised finance (DeFi), gas fees are more than just a technicality—they’re sometimes considered a psychological and financial barrier. Despite the promise of an open, permissionless financial system, many users—especially first-timers—find themselves locked out before they’ve even begun, and this was the same experience Musa had, as I explained above.

This challenge does not run on the surface. it runs deeper than it seems, and I will try to unpack it in the next couple of paragraphs.

Let's Consider How Gas Fees Work (Briefly)

On most blockchains like Ethereum, every action—whether it’s transferring tokens, swapping assets, or interacting with a smart contract—requires computational effort. This effort is paid for using gas, which is denominated in the blockchain’s native currency (e.g., ETH on Ethereum). The cost of this gas depends on the complexity of the action and the current network demand.

In layman's terms, gas is the transaction fee every user must pay to perform actions on the blockchain.

This is fundamentally different from traditional apps, where users rarely have to think about server costs or fees just to click a button.

Here Is Why Gas Fees Are a Major Problem—Especially for New and Mobile Users

For seasoned DeFi users, gas fees are just part of the game - Yeah, everyone simply falls in line and moves on - Hehehehehe. But for newcomers, who often first come in contact with the system through DeFi wallet apps on mobile devices, the experience is shocking and sometimes unexpected. Imagine downloading an app, receiving a free crypto token, and then learning that you need $5 in ETH just to move it. It feels broken. Confusing. Worse, it feels like a scam..... Same way, my Musa friend felt.

This leads directly to crypto adoption challenges, especially among users who aren’t tech-savvy or who come from economies where a few dollars carry serious weight, like in Nigeria.

Mobile users—who make up the bulk of internet users in emerging markets—are especially affected. Most of them interact with apps like WhatsApp, TikTok, or mobile banking platforms where fees are invisible or nonexistent. When these same users face DeFi wallet problems like sudden, unexplained gas fees, the only available option for them or an exit plan would be to simply give up.

Let's Look At The Real-World Impact Of This, As Well As Wallet Abandonment and User Drop-Off

There may be some indications recently showing that the adoption rate of cryptocurrency is experiencing a steady decline. Although several verified and trusted publications and independent research show this, there are also some other counter publications to this.

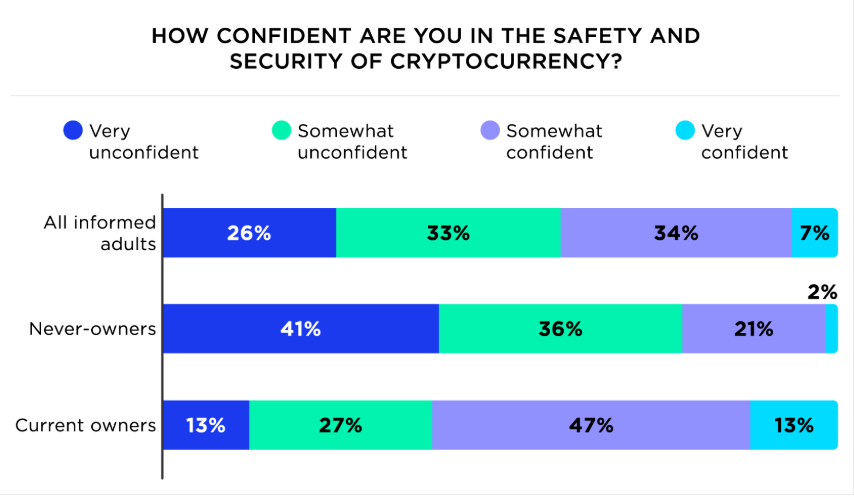

A 2025 Cryptocurrency Adoption and Consumer Sentiment Report indicated that

Despite the growing acceptance of cryptocurrency, especially in Asia, Africa and the Americas, users still seem concerned because of several factors like crypto safety, security and the high cost sometimes attributed to crypto transactions. In this research, it was revealed that 59 per cent of people familiar with crypto aren’t confident in its security, and even 40% of people who own cryptocurrency feel less confident that the technology is safe and secure. Some users have also shown concern about both the growing charges attributed to crypto transactions as well as the difficulty they had experienced at some point withdrawing their funds from custodial platforms.

There have also been plenty of other publications reporting high churn rates by cryptocurrency companies as a result of users abandoning crypto wallets after just one or two failed or expensive transactions. For example, a recent publication by Finance Magnates indicated a whopping 62% customer loss by some crypto businesses as a result of one single failed transaction. Many promising DeFi platforms struggle with low retention because users never make it past their first real interaction, and apart from the high cost of doing transactions, there have also been some attributions to poor user interface. The negative impact of the user Interface leading to a decline in crypto adoption can be found partly in a recent publication by CoinTelegraph

Crypto platforms often invest heavily in marketing - Airdrops, influencer campaigns, banner and search ads in a bid to attract users, only to watch new users abandon the platform ship at the gas fee screen or maybe because the interface feels too complex (Technical). And for those that stick around, the anxiety around “doing it wrong” or losing money can keep them from experimenting with new features and learning.

The Inequality of a $3 Gas Fee

Here’s where it gets truly problematic: economic inequality.

A $3 gas fee in New York might be the price of a coffee, but in Lagos or Mumbai, that’s the cost of a day’s food or weekly transportation. This disparity makes it clear: DeFi is not yet equally accessible. It’s still priced for the privileged.

And as long as gas fees in DeFi remain a hidden cost of participation, millions of people who stand to benefit the most from Web3 tools will continue to be excluded from them..... My humble opinion, though.

Before I Dig Deeper, Let Me Help You Understand Gasless Transactions

In crypto transactions, if gas fees are the lock (They sometimes are), gasless transactions in crypto are the key that opens the door for millions of new users. And the good news is that this is already happening.

What Are Gasless Transactions in Crypto?

In the traditional DeFi experience, you need to pay a gas fee to perform any action on the blockchain—whether it's sending tokens, swapping assets, or minting an NFT. With gasless transactions, that fee is either covered by someone else (usually a sponsor like Gasless.cas) or handled behind the scenes so the user never has to worry about it.

This is made possible through a concept known as meta-transactions.

Meta-Transactions: Making Crypto Feel Like the Apps You Already Use

A meta-transaction is a type of transaction where someone else pays the gas fee on behalf of the user. Here’s how it works:

- The user signs a transaction off-chain (i.e., without spending gas).

- That signed transaction is sent to a special server or service called a relayer.

- The relayer then broadcasts the transaction to the blockchain—covering the gas fee themselves or using a sponsor’s funds.

- The transaction is confirmed on-chain as if the user paid the fee, even though they didn’t.

This entire process can happen within a DeFi wallet app or Web3 interface, making it seamless and frictionless.

What’s a Relayer? What’s a Gas Sponsor?

To simplify:

- A relayer is like a messenger that delivers your signed transaction to the blockchain network.

- A gas sponsor is like a company or platform that pays the delivery fee (gas) for you..... A good example of a gas sponsor would be Gasless Cash

This makes gasless DeFi wallets possible—wallets that allow users to interact with blockchain apps without needing ETH, MATIC, or any native tokens in their wallet.

Imagine downloading a DeFi wallet, getting a token airdrop, and being able to trade it or send it to a friend instantly, without needing to buy or bridge crypto first. That’s the power of gasless infrastructure.

Real Platforms Already Doing This: Gasless Cash, and Others

This isn’t just theory. Several platforms and protocols are actively making gasless transactions in crypto a reality.

Take Gasless.cash, for example. It offers developers APIs to integrate gasless infrastructure directly into wallets and dApps. Developers can plug into this system, allowing users to perform transactions without ever touching ETH or worrying about fees.

Wallet providers and protocols like Biconomy, Gelato, and OpenZeppelin Defender are also enabling similar meta-transaction flows. Many of these tools are built on standards like ERC-2771 (a standard for gasless meta-transactions), and they’re gaining traction quickly across the Ethereum ecosystem and L2S like Polygon and Optimism.

Simple Analogy: Think of It Like Mobile Data Bundles

If blockchain is like the internet, and gas is the data you need to use it, gasless wallets are like apps with built-in free data. You don’t need to recharge before you use the service—it just works.

This model lowers friction, removes confusion, and makes crypto adoption feel a lot more like using WhatsApp or PayPal—and less like solving a tech puzzle.... I hope this helps you.

Now, Let's Consider The Models Behind Gasless Transactions: Exploring Your Options

Now that I have helped you to understand how gasless transactions in crypto work, you might also be wondering: Are there different ways to implement them? Well, the simple answer is yes.

Just like mobile networks offer various ways to access the internet—some bundle data, others let you pay as you go—the world of gasless DeFi wallets also offers several approaches. Each model balances user experience, developer control, and economic sustainability in different ways.

Let’s explore the major options powering gasless crypto transactions and what they mean for users and builders alike.

1. Full Gas Sponsorship (User Pays Nothing)

In this model, the wallet provider, dApp, or blockchain protocol covers 100% of the gas fee for every transaction.

Advantages

- Perfect for onboarding first-time users.

- Completely removes friction from the crypto experience.

- Encourages retention and experimentation.

Disadvantages

- Expensive for the sponsor.

- Not sustainable at scale without a monetisation model.

Real Example to help you understand this model:

Some wallets on Polygon and BNB Chain are experimenting with this, especially during user acquisition campaigns. It’s like giving out free rides on a new transit system.

2. Conditional Sponsorship (Pay-as-you-grow)

Here, gas fees are sponsored based on specific conditions:

- The first 3 transactions are free.

- Only low-gas actions (like voting in a DAO) are covered.

- Users with referral codes or loyalty points get free transactions.

Advantages:

- Incentivises early usage and growth loops.

- Helps control cost while still supporting UX.

Disadvantages:

- Adds complexity for users if not well communicated.

- It can feel like a bait-and-switch if poorly implemented.

Real Example to help you understand this model:

Biconomy allows dApps to define smart rules for sponsoring gas. This lets developers design their own onboarding funnels with fine-tuned economics.

3. Gasless with Token Swaps (Hidden, Not Free)

In this option, users technically still pay for gas—but not with native tokens like ETH or MATIC. Instead, the wallet performs a background token swap using the user’s existing token balance (like USDC or a reward token), then pays the gas behind the scenes.

Advantages:

- No need for users to hold ETH.

- Seamless UX—wallet “just works.”

Disadvantages:

- Might confuse users if token balances drop unexpectedly.

- Relies on liquidity and fast token swaps.

Real Example To Help You Understand the Model:

Wallets like Rainbow and Zerion are exploring variations of this model by allowing gas fees to be paid in ERC-20 tokens.

4. Hybrid or Delegated Models (Community-Powered Gas)

Some systems are building around the idea that validators, node operators, or even other users can cover gas fees on behalf of others, often as part of a larger incentive structure.

Think of it like gas mining or “sponsored bandwidth”, where helping others transact earns you points, tokens, or community status..... Yummy!

Advantages:

- Encourages community-driven adoption.

- Can be gamified for network growth.

Disadvantages:

- Still experimental.

- Needs robust incentives and fraud-prevention mechanisms.

Real Example To Help You Understand The Model:

Projects like Gelato Network and some DAO-governed Layer 2s are toying with community-relayer pools and governance-funded gas models.

So, What’s the Best Model?

There’s no one-size-fits-all. The best approach depends on your audience, budget, and goals. But here’s what’s clear: if your platform doesn’t make onboarding feel effortless, someone else’s will. And gasless crypto transactions are shaping up to be a defining UX standard, not a bonus feature.

Whether you're a user looking for smoother experiences or a builder aiming to drive crypto adoption, understanding these gasless transaction models is key to navigating the next phase of DeFi wallet apps and Web3 growth.

Making the Right Choice: Selecting the Best Gasless Model

So, we’ve explored the various gasless transaction models powering today’s innovative DeFi wallet apps. But with all these options, a critical question arises:

Which gasless model fits your users—and your growth goals—the best?

This isn’t just a technical decision. It’s a strategic choice that should align with your user demographics, regional markets, and product vision. Let’s break it down by intent, location, and user experience priorities to help you select smartly.

1. For First-Time Crypto Users in Emerging Markets

“I just downloaded a wallet and don’t even know what ‘ETH’ means.”

These users are typically mobile-first and highly cost-sensitive. A $3 gas fee can literally feel like a luxury tax in cities like Lagos, Mumbai, or Dhaka.

Best Fit:

Full Sponsorship or

Conditional Sponsorship (with generous onboarding)

Why:

You need to remove every possible friction, especially the need to buy or hold native tokens. Your goal is instant usability. Once trust is built, monetisation can follow.

2. For Users in Mature Markets (U.S., Europe)

“I’ve used Coinbase, and I want better control over my assets.”

These users are relatively educated about crypto, care about convenience and control, and often juggle multiple tokens and chains.

Best Fit:

Gasless via Token Swap Model

Why:

These users may already hold ERC-20 tokens and are less price-sensitive, but still want the magic of a wallet that “just works.” Swapping USDC or DAI for gas behind the scenes improves UX without removing user agency.

3. For Communities & DAOs Looking to Onboard at Scale

“We’re trying to onboard 10,000 users and make them vote in our DAO.”

Here, the goal is not just usability, but participation at scale.

Best Fit:

Hybrid or Delegated Gas Models

Why:

Gas sponsorship can be community-funded. Plus, gamifying gas coverage through rewards or governance incentives adds long-term sustainability. Great for social impact projects, Web3 education campaigns, and ecosystem DAOs.

4. For App Developers Launching a New dApp

“We’re building a DeFi app and need early traction.”

For startups, conversion is everything. You can’t afford to lose users at the “approve transaction” screen.

Best Fit:

Conditional Sponsorship with flexible rules (via Biconomy or Gelato integrations)

Why:

This lets you test different onboarding funnels—sponsor just enough to get users through the door, while monitoring usage and retention metrics. Balance cost with performance.

The Selection Isn’t Forever—It’s Strategic

Keep in mind: the model you select today doesn’t have to be your permanent solution. Think of it like customer acquisition in any business. You may start with full sponsorship, then transition to swaps or tiered coverage once your user base is active.

By aligning your gasless transaction strategy with user expectations, location-specific barriers, and your product’s growth stage, you're not just solving a technical problem—you’re unlocking real crypto adoption.

Execute & Evaluate: How You Can Start Using Gasless DeFi Wallets (And Know It’s Working)

By now, you understand the pain of gas fees and the promise of gasless crypto transactions. So what’s next?

This final section is about two things:

- Execution: How you, the individual user, can start using gasless DeFi wallets right now.

- Evaluation: How to know if it’s actually helping your crypto journey.

This isn’t a developer guide. It’s a roadmap for real people like you, especially if you live in a climate where even $1 in gas can stop you from exploring Web3.

How to Start Using Gasless DeFi Wallets Today

You don’t need to code. You just need the right wallet and a few simple steps.

1. Download a wallet that supports gasless transactions

Look for DeFi mobile wallets that already integrate gasless features. Examples include:

- Rainbow Wallet – Known for user-friendly design and occasional gas-free promos.

- Zerion – Offers gasless swaps on select tokens.

- BlockWallet – Privacy-focused and supports meta-transactions.

- Trust Wallet (with limited features) – Gasless swaps via partners during campaigns.

- Wallets using Biconomy or Gasless cash under the hood

Pro Tip: Always check their website or FAQ section for “gasless” or “meta-transaction” support.

2. Try a transaction

Most wallets with gasless support will tell you upfront:

“This transaction will be processed without gas.”

It might be your first token swap, a vote in a DAO, or minting a free NFT. The wallet or app will cover the gas using a relayer—a service working quietly behind the scenes.

3. Start exploring more confidently

Once you know that gas isn’t a blocker, you can start:

- Testing new DeFi tools

- Voting on community proposals

- Trying micro-transactions (even $1!)

- Sharing crypto with friends

- Engaging without worrying about the cost

How to Know It’s Actually Helping You

Here’s how to evaluate if a gasless wallet is right for you:

Here are the signs you should look for:

1. You’re using your wallet more often

2. You’re not stuck waiting to “save up gas

3. You're making small transactions you used to avoid

4. You understand what’s happening when gas is covered

5. You’re recommending the wallet to others

From my personal experience, both transacting crypto and listening to others talk about cryptocurrency these are usually the signs people always talk about when they feel confident about a platform.

🙌 Why This Matters (Especially If You Live in an Emerging Market)

If you’re in places like Lagos, Mumbai, Manila, or Nairobi, where $3 in gas can feel like $30, then gasless DeFi wallets are not just convenient—they’re empowering.

- You no longer have to wait till payday to try a DeFi tool.

- You don’t need to ask a friend to help you “unstick” a wallet.

- You don’t need to fear blockchain fees as something that’s “not for people like you.”

Gasless wallets flip the script. They make crypto usable for you—the real people Web3 is supposed to help.

Final Word: It’s Your Wallet, Your World—Use It Without Limits

Gas fees have stopped too many people from experiencing the best of crypto. But with gasless wallets, that barrier is crumbling.

So go ahead:

Download a wallet. Try a gasless transaction. Feel the difference.

Because when friction disappears, crypto adoption doesn’t just grow—it explodes.